The beauty market in Vietnam is experiencing rapid growth. This vibrant environment provides new, exciting prospects when exploring cosmetics market in Vietnam.

Investors, international distributors, and brands need to learn about this market. This report gives a comprehensive overview of cosmetics market in Vietnam by 2026.

You will learn about market size, consumer behavior, distribution channels, and export potential.

1.The Cosmetics Market in Vietnam and Its Growing Potential

Vietnam ranks among the booming, vibrant spots in the beauty industry. It demonstrates high growth in its cosmetics market.

This makes it a favorable destination for international players. We will discuss the motivation behind such impressive expansion.

This resource presents guidance for people who want to join this booming industry.

We examine the most critical market information and consumer analysis. We also cover essential distribution channels.

You will clearly understand the regulatory environment. We also touch on the prospective export potential of Vietnamese beauty products.

This resource will empower your strategic decisions.

2. Market Dynamics: Growth, Consumers, and Trends

2.1 Vietnam Cosmetics Market at a Glance

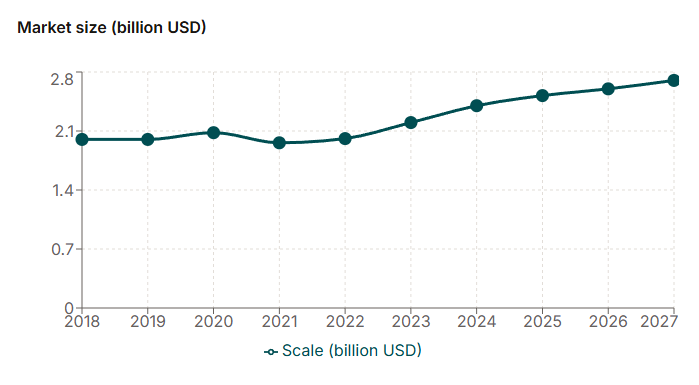

The Vietnamese cosmetics market continues performing well upwards. Analysts estimate healthy growth rates up to 2026.

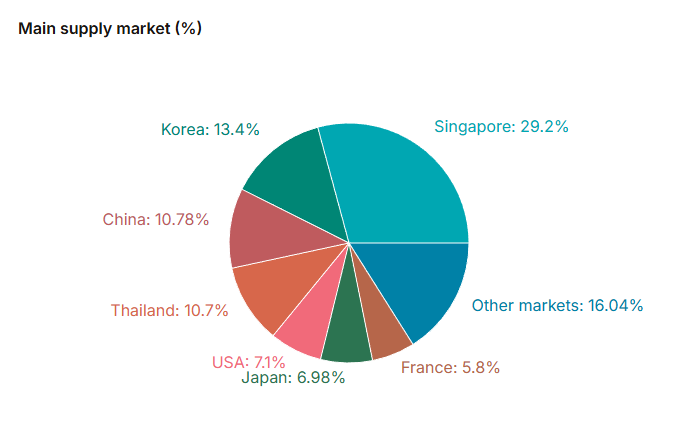

A number of essential factors drive this. Imported cosmetics now dominate the market share.

Nevertheless, local cosmetic brands are gaining steady ground.

A young and steadily growing wealthy population fuels this. Urbanization contributes as a factor.

More people live within cities with higher disposable incomes. Massive digital usage also modifies buying behavior.

These factors make the market fertile for beauty products.

2.2 Vietnamese Beauty Consumers & Key Trends

Consumer Profile

The Vietnamese beauty consumer demonstrates diverse purchasing behaviors across multiple channels. Vietnamese consumers show a strong preference for multi-channel shopping, with 31% choosing to increase their online platform usage, 25% favoring specialty beauty stores, and 24% purchasing at supermarkets.

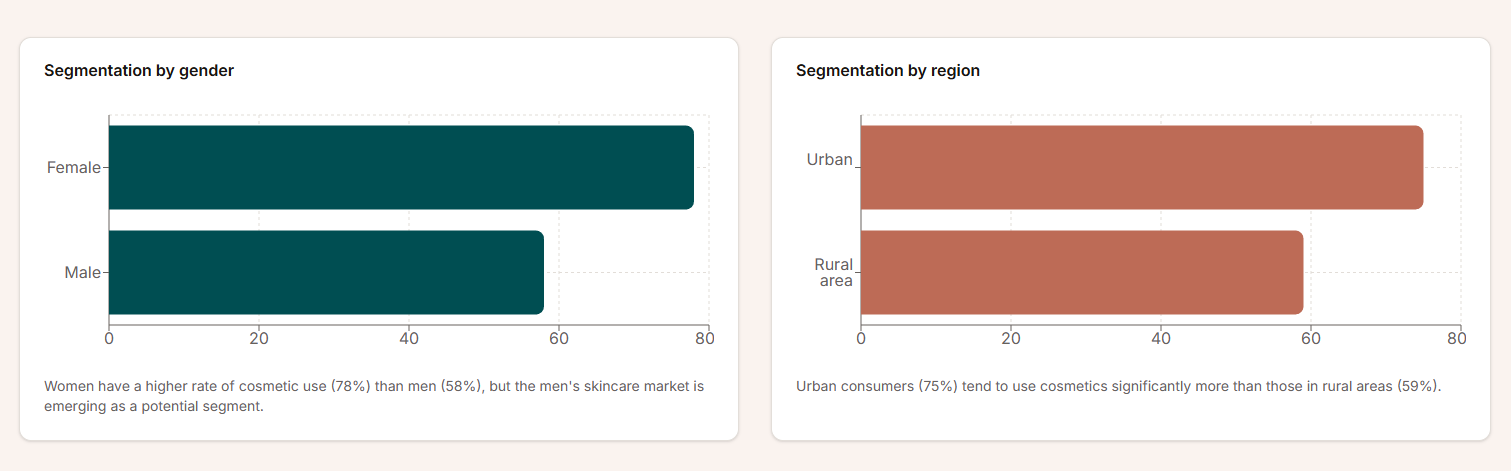

Gender and Age Patterns:

Female consumers shop online significantly more than males (42% vs 19%)

The 18-24 age group shows the highest engagement with online channels (36%) and specialty beauty stores (31%)

Consumers aged 25+ spend only 20% on online purchases, preferring traditional retail channels

The majority of Vietnamese consumers are concentrated in urban areas, particularly Ho Chi Minh City and Hanoi, where both Gen Z and Millennials allocate substantial portions of their income to beauty and personal care products.

What Matters Most to Vietnamese Consumers

Price Sensitivity and Value Perception: The largest consumer segment (45%) is satisfied with a moderate price range of 200,000-500,000 VND per product, reflecting a preference for accessible yet quality options. However, the market shows clear stratification:

12% are willing to spend over 1 million VND, indicating potential for premium segment growth

9% of urban consumers are prepared to spend 2 million VND or more

Conversely, 44% of rural consumers prefer products under 200,000 VND, highlighting the clear differentiation between urban and rural purchasing power

Core Purchase Drivers: Beyond pricing, Vietnamese consumers prioritize safety and gentleness in formulations, with non-irritative products being highly preferred. Natural ingredients continue to gain traction, with consumers carefully scrutinizing product labels to ensure alignment with their values.

Brand reputation and product authenticity remain critical factors, as consumers are increasingly wary of counterfeit products. Social media, KOLs, and KOCs play pivotal roles in building trust and influencing purchase decisions through reviews and recommendations.

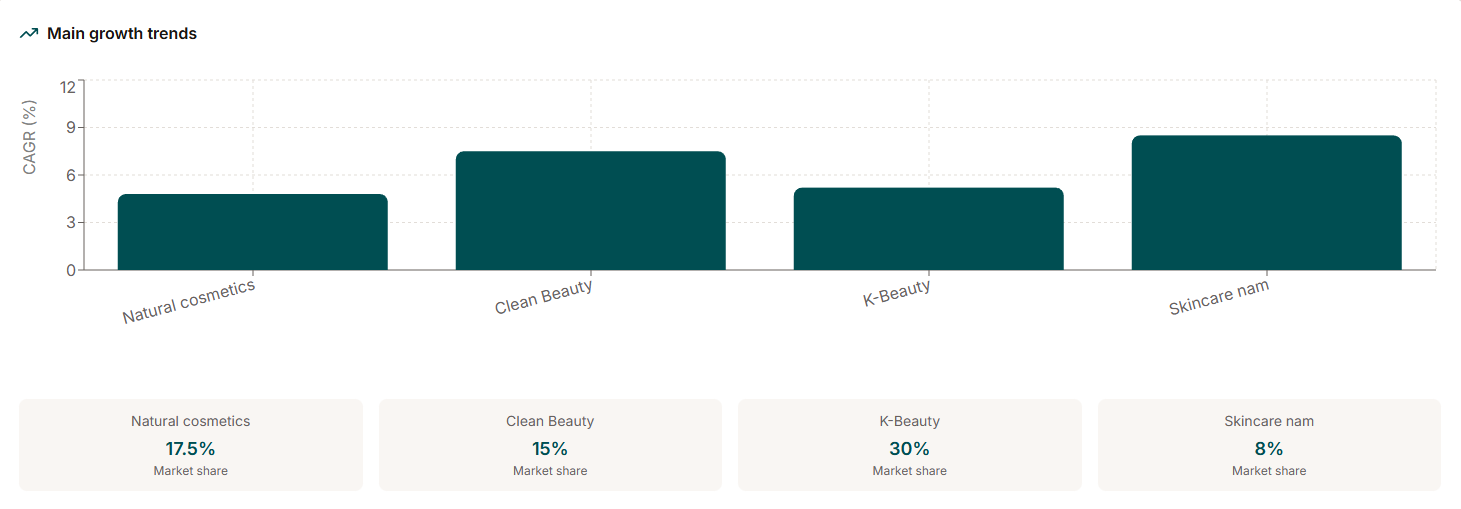

Notable Market Trends

A number of interesting beauty trends are emerging in the cosmetics market. Men’s grooming products are growing in popularity.

Teen skincare represents another very fast-growing segment. Younger consumers are beginning their skincare routines at younger ages.

This shows a long-term commitment toward skin health.

The demand for natural, organic cosmetics and vegan beauty is booming. Clean beauty products also enjoy high demand.

Consumer interest in sustainable products continues to rise. The use of beauty salons and clinic services is flourishing.

Treatments such as head spa and herbal hair washing are very popular.

3. Brands, Distribution & Regulations

3.1 Local vs International Brands

Foreign beauty brands hold a predominant influence in Vietnam. These brands bring global reputation and extensive product lines.

They master sophisticated formulas and extensive promotion. They offer well-established product selections.

Nevertheless, Vietnamese brands are rapidly increasing in market share when it comes to cosmetics market in Vietnam. They often specialize in natural ingredients.

Some focus on local values and environmental friendliness. They position themselves as affordable makeup and skincare options with quality.

Brands such as Cocoon, Emmié by HappySkin, and Skinna stand as prominent examples.

| Brand Type | Unique Selling Proposition (USP) | Price Tier | Main Target | Main Channels |

| International Brands | Global reputation, advanced formulas, a diverse range | Mid to Luxury Beauty | Urban, affluent, trend-conscious | Modern retail, e-commerce, department stores |

| Local Vietnamese Cosmetics | Natural formulations, cultural relevance, and cost-effectiveness | Affordable to Mid | Mass market, eco-conscious, local supporters | E-commerce, specialized beauty stores, and pharmacies |

3.2 Main Distribution Channels in Vietnam

Modern retail and pharmacies serve as important outlets. Drugstores and beauty chains offer broad accessibility.

They provide easy product sourcing and trust. Nevertheless, new entrants face competition regarding shelf space.

Social commerce and e-commerce are experiencing rapid growth. E-commerce platforms such as Shopee and Lazada prove important.

Livestream selling and TikTok Shop lead to impulse purchases. These platforms reach widely and touch consumers directly.

They work particularly well in appealing to youth.

Professional channels comprise spas, beauty salons, and clinics. They suit high-end skincare and treatments perfectly.

They provide professional consultation and premium experiences. Traditional markets also remain, but carry more chance of counterfeits.

Reputable beauty products consumers usually avoid them.

3.3 Regulations in Brief

The Ministry of Health (MoH) serves as the critical regulatory body. It regulates the legal framework for cosmetics market in Vietnam.

Every cosmetic product must provide a Product Notification. This ensures product safety.

Importing companies must also produce a Certificate of Free Sale (CFS).

Import duties can influence product pricing levels. These responsibilities affect a brand’s competitiveness.

Understanding these tariffs proves important for market entry. Companies are required to comply with all regulations.

This benefits both consumers and businesses by ensuring protection.

4. Export Potential and Future Outlook

4.1 Export Potential of Vietnamese Cosmetics

Vietnam’s cosmetic exports currently lag behind imports. Nevertheless, this industry shows positive, slow development.

Vietnamese brands prove attractive for several reasons. Their products offer cost-efficient production.

Many emphasize natural and traditional ingredients.

International distributors should consider Vietnamese brands. They provide strong OEM/ODM (Original Equipment Manufacturer/Design Manufacturer) alternatives.

This enables customized product development. You can attend trade shows to find export-ready brands.

Retail scanning and connecting with vetted manufacturers also facilitates this.

4.2 FAQ: Cosmetics in Vietnam

Is Vietnam a promising cosmetics market in the next few years?

Yes, Vietnam holds great potential when it comes to cosmetics market in Vietnam. Its youthful demographics, rising income, and online usage contribute to sustainable market growth.

What do Vietnamese consumers care about most when buying cosmetics?

Vietnamese consumers emphasize product safety, gentle formulas, and natural ingredients. They also attach enormous importance to brand trust and authenticity.

Which channels are most effective for launching a new brand in Vietnam?

New brands can promote themselves using e-commerce and social commerce platforms such as TikTok Shop and modern retail stores when entering the cosmetics market in Vietnam.

Do “Made in Vietnam” cosmetics have realistic export opportunities?

Yes, they do. Vietnamese cosmetics offer appealing prices, natural ingredient promotions and good OEM/ODM capabilities for promoting internationally.

Conclusion & Next Steps

The Vietnamese cosmetics market presents both opportunities and challenges when dealing with cosmetics market in Vietnam. Its dynamic growth and engaged consumer base offer significant potential.

Navigating regulations and understanding distribution channels are key. Strategic planning will unlock success in this vibrant market.

For international distributors aiming to enter Vietnam, thorough market research proves essential. Engage local experts to manage compliance effectively.

For sourcing Vietnamese products for export, attend local trade shows. Seek manufacturers known for quality and natural ingredients.

The future for cosmetics market in Vietnam looks bright and full of innovation.

What Makes Beauty Summit 2026 Special? Looking Back at Memorable Moments from Previous Years

Beauty and Aesthetics Conference: 5 Game-Changing Expert Takeaways You Cannot Miss

Inviscar at Beauty Summit 2026: Pioneering Scar Treatment Innovation

Professional Beauty Event Guide 2025–2026: Global Calendar, Tips & ROI Playbook

Beauty Industry Event Guide: Top Global Shows & Trends for 2025

Global Cosmetics Expo: Top 5 Key Insights For Shaping Beauty’s Future